Has the CAA resurrected the concept of commercial operations?

Or has an inability to join up thinking between silos created yet another internal inconsistency?

Edit 28/05/2024: With huge thanks to the CAA for coming back so quickly on my questions around this. Today I received confirmation that:

“where a flight is determined to be ‘sport and recreation’ insurance is not required. The responsibility for insurance falls on the operator and will not be checked during oversight.”

This last section in italics is interesting given the contents of CAP 2606 with its insistence on all flights being insured against EC no 785/2004. Oh, to know the mind of the regulator.

This is precisely the clarification I expected, but it underlined the lack of trust we can place in the CAA’s own Operations Manual Template.

End of edit.

An interesting question arose during an online debate this week. What was most fascinating was that during the debate a UK CAA staff member (a Policy Lead in the UAS area no less) stated that:

“…there are no ‘permissions’ for commercial UAS operations in UK law.”

The comment was in response to a simple statement on LinkedIn within a ‘Top 10 safety considerations’ type post that can be found here. It said, “Do not conduct commercial drone operations without the appropriate permissions and insurance.”

Now, we can dig into the semantics of whether or not the poster stated that CAA granted permissions are required for commercial operations (they aren’t). But that isn’t what I want to look at here.

I’d prefer to see whether the CAA itself truly believes that “there are no ‘permissions’ for commercial UAS operations in UK law” and to do this I’m going to take the lovely new, box-fresh CAP 2606 issue 1.1 “PDRA01 Operations Manual template and apply a bit of logic to its contents.

Definitions

Before I do, let’s just clarify “commercial” operations in this context. The law, (in the form of together with CAA guidance states that all UAS flights require insurance compliant with (EC) 785/2004 apart from a few irrelevant exceptions and the very relevant “’model aircraft’ with an MTOM of less than 20kg”.

The CAA states that for the purposes of the insurance legislation, “the term ‘model aircraft should be taken to mean:

“Any unmanned aircraft which is being used for sport or recreational purposes only”.

Almost without exception, the community refers to ‘model aircraft’ flying as ‘hobby’ flying in the context of UAS. Claim other type of flying is nearly always referred to as ‘commercial’ flying.

Watch that weight of 20kg by the way, it may be relevant later on.

What’s Eyeup’s claim here?

Eyeup’s point is that the CAA’s template for a PDRA01 operations manual essentially assumes that every flight is “’commercial’ (i.e. not for sport or recreation) in nature. Let’s be clear that I don’t believe that this is the intention of the template. I’m afraid it is just another document written by those outside the industry who don’t seem to be able to produce or review documents holistically.

So, where’s the evidence?

The evidence is easy to find. It can all be found in CAP 2606 and is based around the CAA’s attitude to insurance, which is the only remaining defining feature of ‘commercial’ operations. This can be shown in two really simple steps. Reference numbers shown are from the sections in CAP 2606.

Step 1.

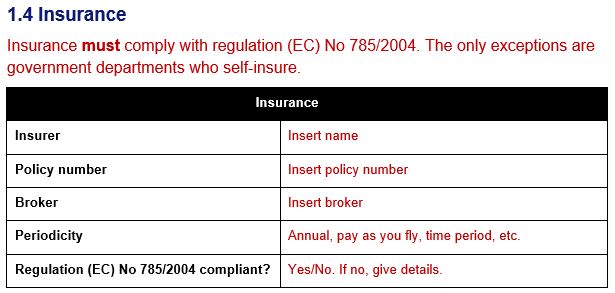

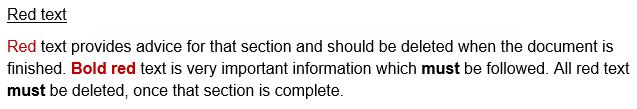

According to CAP 2606 section 1.4, insurance taken out by the operator MUST comply with (EC) 785/2004. This is not a suggestion in the template, but a mandatory requirement. I have provided the key to the colour-coded text as it appears in the template, since it leaves no doubt as to the mandatory nature of the requirement.

Key

Step 2.

Step 1 on its own is fine. After all, the statement that insurance must comply with (EC) 785/2004 is fine, because we don’t always need to take out insurance do we? OK, section 1.4 is a little overbearing in its approach…but this is a regulator, right?

The problem comes a little later in the template.

Tucked away the bottom of section “1.6.1 [Responsibilities and duties of the] UAS Operator” is this little gem:

“Responsibilities: Ensuring insurance is in place for every flight.”

A slam dunk!

There it is. In two simple statements, if an operator uses the CAA’s own “strongly recommended” template, they will commit themselves to full, “professional” level insurance (at a significantly higher cost than hobby cover) for every single flight they undertake.

No flights are considered to be for sport or recreational purposes, even if it’s one, for example, from a beach within 50m of a congested area where you intend to take off using your 30m allowance and fly directly out to sea and back again.

By default, the CAA has made it very clear that in contradiction to the legislation and without the apparent knowledge of its Policy Leads in the UAS Sector, PDRA01 flights in the specific category are all classed as ‘commercial’.

Is this their intention or just another error, a mere glitch in the matrix that makes up the multi-siloed activities of the CAA UAS department?

Not my first rodeo

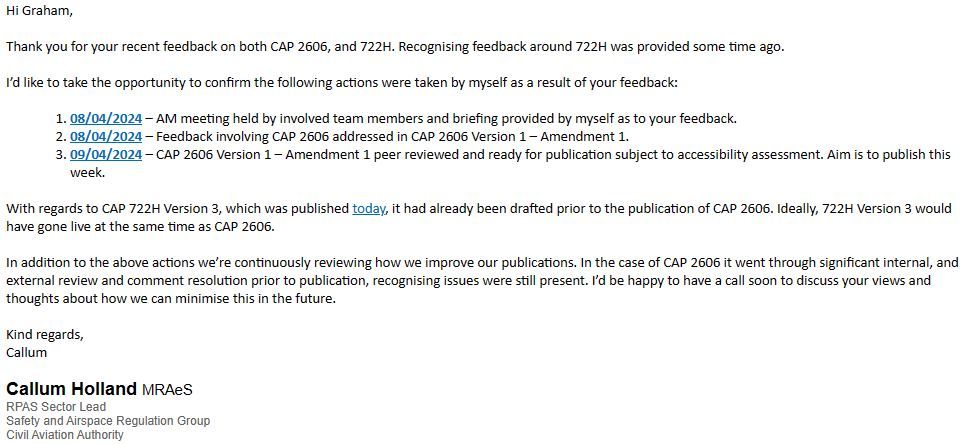

I say “another error because this isn’t the first time I have turned my sights on CAP 2606. This document was soft launched at the beginning of April 2024. As soon as I became aware of it, I did a quick and dirty run-through and fired of a bunch of questions to the CAA which, to its credit, reacted promptly. So promptly in fact that a mere handful of working days later, version 1.1 was hot off the press.

CAA CAP 2606 Review email

Picky, moi?

Am I just being picky here? Am I just trying to prove a point?

Well actually, yes.

The point is that operators choosing to use the CAA template can easily fall into a trap. They can take their drone on holiday and use it for a perfectly legitimate specific category flight over their accommodation or local (congested area) beauty spot. They can plan for it and carry it out safely. However, if they work on a “pay as you fly” insurance basis and fail to trigger the insurance then in an audit the CAA could find them wanting.

What that means in reality we just don’t know. But the CAA always reserves the right to remove an authorisation from a UAS Operator.

If the CAA doesn’t mean what the document says, then the issue is incredibly easy to resolve. Just change the wording in section 1.4 Insurance to something like this (from the Eyeup PDRA01 Gateway manual):

“The Organisation shall maintain third party indemnity insurance in accordance with EU regulation (EC) No.785/2004 while engaged in any flights that are not sporting or recreational in nature or any flights using a UA with a maximum take-off mass of between 20kg and <25kg.”

Oh, notice those last few words? We’re back to the wording of (EC) 785/2004. The difference between a 20 and 25kg UA is that anything 20kg or above MUST be insured to the ‘commercial’ level.

Perhaps that’s why the CAA used the wording it did, because the PDRA01 OA allows for flights with UAS up to 25kg. It’s not a strong argument though. CAP 2606 is designed as a template. Where text is misleading or incorrect in a certain situation (i.e. the common one where the huge majority of UAS Operators are working with platforms under 10kg), then it should be written to remove ambiguity.

Conclusion

In conclusion, legally no, there is no distinction between commercial or any other type of flight, other than the need to obtain a specific form of more ‘professional’ insurance for flights that are not sporting or recreational in nature or for flights using anything of 20kg or above.

The reasonable conclusion is that the CAA has managed to confuse itself once again within the pages of one of the key documents covering UAS in the Specific Category. This time in the template they suggest operators use to remain “compliant”. The question is, compliant with what?

Oh, and remember that any flight, including sporting, recreational, commercial (or any other type), may require permissions or authorisations, even licences outside those granted by the CAA.

Sincere apologies

I must apologise to the CAA for not having picked up on this issue back at version 1 of CAP 2606 when I reviewed it in early April. Still, given my special consultancy rate for these matters (£/0.00/hr) and the fact I got to it eventually, I hope you won’t mind too much.

The best insurance

In my mind, the best insurance is either to continue to update a manual which has been signed off as acceptable by the regulator in the past, or to get your manual updated to a version which was being singed off as acceptable even after the date that CAP 2606 was introduced. A version that takes into consideration the mitigations in 722H and follows the other preferred format of CAP 722A.